Understanding PayPal Transaction Fees in the UK

If you’re a UK business owner using PayPal to process transactions, you’re likely aware that fees are involved. But do you really understand how they work? You might be surprised to find that PayPal transaction fees are more complex than just a flat rate. As you process domestic and international transactions, you’re charged varying fixed fees and percentage rates, depending on the nature of the transaction and the recipient’s location. Understanding these fees can save you money in the long run. So, how do these fees affect your bottom line, and what can you do to minimize them?

Types of PayPal Transaction Fees

The various types of PayPal transaction fees can be confusing, but understanding them is crucial to managing your online payments effectively.

You’ll encounter different fees depending on the type of transaction you’re making. PayPal charges fees for cross-border transactions, which involve sending or receiving payments from countries outside the UK.

You’ll also be charged for converting currencies when you make international transactions.

If you’re selling products or services through PayPal, you’ll be charged a payment processing fee.

This fee varies depending on the type of transaction and your account type.

Another type of fee you might encounter is the micropayment fee.

This applies to transactions under a certain threshold, typically £10. PayPal also charges fees for instant transfers and other types of transactions that involve expedited processing.

Domestic Transaction Fees Explained

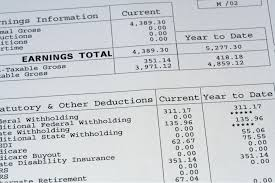

When you make domestic transactions through PayPal, you’ll want to understand the associated fees. In the UK, domestic transaction fees are relatively straightforward.

For standard transactions, you’ll pay a fixed fee of 30p plus a small percentage of the transaction amount. The percentage varies depending on the type of account you have. For business and premier accounts, the fee is 2.9% of the transaction amount. For personal accounts, there’s no fee for receiving transactions from friends and family, but you’ll pay 2.9% for receiving commercial payments.

You’ll also pay fees for other domestic transactions, such as instant bank transfers and withdrawals. The fees for these services vary depending on the amount and method of transfer.

To avoid surprise fees, it’s essential to check the PayPal fees page for the most up-to-date information on domestic transaction fees.

In addition to these fees, some sellers may also charge you a handling fee or other surcharges. PayPal encourages sellers to be transparent about these fees, but it’s your responsibility to understand what you’re paying.

International Transaction Fees UK

Making international transactions through PayPal from the UK involves additional fees.

As you send or receive cross-border payments, these fees are usually higher than those for domestic transactions.

This is because PayPal needs to cover the costs of converting currencies and facilitating international transfers.

When making international transactions through PayPal from the UK, you’ll want to consider the following key points:

- Cross-border fees apply: You’ll be charged an additional fee for sending or receiving payments from other countries.

- Currency conversion rates are used: PayPal will use its own exchange rates to convert currencies, which may not be as favorable as those offered by banks or other providers.

- Fees vary by country and payment type: The fees you pay for international transactions will depend on the country you’re sending to or receiving from, as well as the type of payment you’re making (e.g., goods, services, or personal payments).

These factors can affect the overall cost of your international transactions through PayPal.

Fixed Fees and Percentage Rates

You’ll typically face two main types of fees when using PayPal: fixed fees and percentage rates. Fixed fees are flat charges applied to transactions, usually for domestic payments. These fees are typically small and predictable.

For example, PayPal’s standard domestic payment fee in the UK is 30p per transaction for most payment types.

Percentage rates, on the other hand, are variable fees calculated as a percentage of the transaction amount. PayPal charges a percentage fee for cross-border transactions and certain domestic payment types, like card payments.

The percentage rate varies depending on the nature of the transaction, the recipient’s location, and the payment method.

In the UK, PayPal’s standard percentage fee for cross-border transactions is 1.5% to 2% of the transaction amount. For domestic card payments, the percentage fee is typically 2.9% + a fixed fee of 30p.

You should factor in these fixed fees and percentage rates when calculating the costs of using PayPal for your transactions. This will help you better understand the fees you’ll be charged and make informed decisions about your payment options.

Minimising PayPal Transaction Costs

Minimising PayPal Transaction Costs

To reduce your overall UK PayPal fees breakdown costs, it’s essential to understand the fee structures and payment methods that work best for your transactions.

You can start by understanding the different types of fees and how they apply to your transactions. This will help you make informed decisions about how to manage your costs.

Here are some ways you can minimise your PayPal transaction costs:

- Use domestic payments: If you’re sending money to someone within the UK, use PayPal’s domestic payment service, which typically charges lower fees than cross-border payments.

- Use PayPal’s micropayment fees: If you’re processing multiple low-value transactions, consider using PayPal’s micropayment fees, which can save you money on transaction fees.

- Qualify for merchant rate discounts: If you’re a business with a high volume of transactions, you may qualify for merchant rate discounts, which can reduce your transaction fees.

Conclusion

Now that you’ve got a better grasp of PayPal transaction fees in the UK, you’re more equipped to navigate the complexities of online payments. By understanding domestic and international fees, fixed fees, and percentage rates, you can make informed decisions about your transactions. Minimise your costs by choosing the right payment options and keeping an eye on currency conversion rates – it’s all about making the most of your money.