The Importance of Regular Audits Insights From Koh Lim Audit Singapore

As you evaluate the financial health of your organization, you’re likely to consider various measures to ensure transparency and growth. According to insights from Koh Lim Audit Singapore, regular audits play a crucial role in this process. But what specific benefits can audits bring to your business? By examining your financial statements and internal controls, an audit can identify potential risks and areas for improvement. But that’s just the beginning – a thorough audit can also drive business growth strategies and maintain regulatory compliance. What does this mean for your organization’s future, and how can you leverage audits to your advantage?

Enhancing Financial Transparency

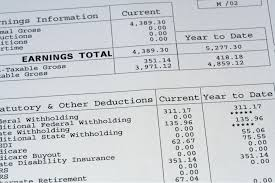

Regular audits play a crucial role in enhancing financial transparency, allowing you to gain a clearer picture of your organization’s financial health. They provide you with an unbiased, third-party assessment of your financial statements, which can be used to make informed decisions about your business.

By conducting regular audits, you can identify and correct any errors or discrepancies in your financial reporting, ensuring that your financial statements accurately reflect your organization’s financial position.

Audits also help you to identify areas where you can improve your financial processes and internal controls. This can lead to increased efficiency, reduced waste, and better financial management.

Moreover, regular audits can provide stakeholders, such as investors and lenders, with confidence in your organization’s financial health and management. This can lead to increased trust and credibility, which can be essential for securing funding or attracting new business.

Minimizing Business Risks

By proactively assessing your organization’s financial health, you can pinpoint potential risks that could jeopardize your business. A regular audit can help identify areas of vulnerability and provide recommendations to minimize these risks.

| Risk Type | Description | Mitigation Strategy |

|---|---|---|

| Financial Risk | Inaccurate financial reporting, poor budgeting, and inefficient resource allocation. | Implement robust financial controls, maintain accurate records, and engage auditors to review financial statements. |

| Operational Risk | Inefficient processes, inadequate training, and poor supply chain management. | Streamline operations, invest in employee training, and establish contingency plans for supply chain disruptions. |

| Compliance Risk | Non-compliance with regulatory requirements, laws, and industry standards. | Stay up-to-date on regulatory changes, implement compliance policies, and conduct regular compliance audits. |

Driving Business Growth Strategies

Your organization’s financial health is now on a stronger footing, thanks to proactive risk assessment and mitigation strategies.

With a solid financial foundation in place, you can focus on driving business growth strategies. A well-planned audit can help you identify opportunities to optimize operations, streamline processes, and allocate resources more efficiently. This, in turn, enables you to invest in strategic initiatives that drive growth and increase revenue.

Identifying Areas for Improvement

Identifying Areas for Improvement

As you delve into the audit process, identifying areas for improvement becomes a critical step in strengthening your organization’s financial health. You’ll be able to pinpoint inefficiencies, inefficacies, and potential risks that may be hindering your growth. By doing so, you can make informed decisions to address these issues and steer your business towards success.

| Area of Improvement | Potential Solutions |

|---|---|

| Inefficient Accounting Processes | Automate tasks, implement new accounting software |

| Inadequate Internal Controls | Develop and enforce stricter policies, provide training for employees |

| Poor Budgeting and Forecasting | Implement a rolling forecast, conduct regular budget reviews |

| Ineffective Risk Management | Develop a comprehensive risk management plan, conduct regular risk assessments |

Maintaining Regulatory Compliance

Maintaining Regulatory Compliance

Regulatory compliance is at the heart of every successful organization, and you must stay on top of it. As a business owner, you’re responsible for ensuring your company adheres to relevant laws, regulations, and standards.

Failure to comply can result in severe penalties, fines, and damage to your reputation.

Regular audits play a crucial role in maintaining regulatory compliance. By conducting audits, you can identify areas where your organization may be at risk of non-compliance and take corrective action before it’s too late.

Here are three key ways audits help with regulatory compliance:

- Risk assessment: Audits help you identify potential risks and vulnerabilities in your organization’s processes and systems, enabling you to take proactive measures to mitigate them.

- Compliance monitoring: Audits ensure that your organization is adhering to regulatory requirements and internal policies, reducing the risk of non-compliance.

- Corrective action: Audits provide insights into areas that require improvement, allowing you to implement corrective measures to maintain regulatory compliance.

Conclusion

You’ve seen how regular audits can transform your organization. By conducting them, you’ll enhance financial transparency, minimize business risks, and drive growth strategies. Audits identify areas for improvement and ensure you’re meeting regulatory requirements. This not only boosts stakeholder confidence but also supports in Koh Lim Audit PAC Singapore med decision-making. By prioritizing regular audits, you’ll be well on your way to achieving your organization’s long-term success and sustainability. This proactive approach will pay off in the years to come.