How to File an Insurance Claim for Investment Scam Losses

If you’ve fallen victim to an investment scam, you’re not alone. Many people have been in your shoes, and there’s a chance you might be able to recoup some of your losses through an insurance claim. But before you start the process, it’s essential to understand the steps involved and the types of insurance coverage that might apply. You’ll need to gather specific documents and notify your insurer promptly to avoid any potential delays. But where do you even start, and what exactly will you need to do to get the ball rolling on your claim?

Types of Insurance Coverage

When you’re dealing with investment scam losses, navigating insurance coverage can be a complex and daunting task. You’ll need to understand the types of insurance coverage available to determine if you have a valid claim.

You might’ve Errors and Omissions (E&O) insurance coverage, which protects you against losses caused by professional negligence or wrongdoing. Alternatively, you may have Directors and Officers (D&O) insurance, which covers the actions of company directors and officers.

Some investment firms also offer fidelity bonds or crime insurance, which can provide coverage for losses due to theft or deceit.

If you have a business, you might’ve a commercial insurance policy that includes coverage for investment-related losses.

It’s essential to review your policy documents to determine the scope of coverage and any applicable exclusions.

You should also check if you have any umbrella or excess liability policies that might provide additional coverage.

Knowing the types of insurance coverage you have is crucial to determining your next steps in filing a claim for investment scam losses.

Gathering Required Documents

Now that you’ve identified the types of insurance coverage you have, it’s time to gather the required documents to support your claim for investment scam losses.

Start by collecting proof of the investment, such as contracts, account statements, and receipts.

You’ll also need to provide documentation of the scam, including police reports, complaint letters, and any communication with the scammer.

Gather all relevant correspondence, such as emails, letters, and text messages, that relate to the investment and the scam.

If you’ve reported the scam to any regulatory agencies, obtain a copy of the report.

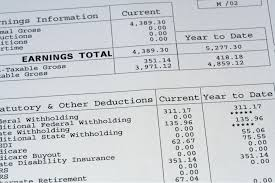

You’ll also need to provide financial records, such as bank statements and tax returns, to demonstrate the extent of your losses.

Make sure to keep all original documents and create copies for your records.

Organize the documents in a clear and concise manner, labeling each document and categorizing them by type.

This will make it easier for your insurer to review your claim and process it efficiently.

Having all the necessary documents in order will help you build a strong case for your claim.

Notifying Your Insurer

Notify your insurer about the investment scam losses as soon as possible. This step is crucial in initiating the claims process.

When you notify your insurer, they’ll guide you on the next steps and provide you with the necessary information to proceed with your claim. You can usually notify your insurer by phone, email, or through their website.

Make sure to have your policy number and a brief explanation of the investment scam ready when you contact them.

When you notify your insurer, be prepared to provide some preliminary information about the scam. This may include the name of the individual or company involved in the scam, the amount of money lost, and the date of the incident.

It’s essential to be honest and transparent about the circumstances surrounding the scam. Your insurer may also ask you to provide some supporting documentation, but don’t worry about that yet – you’ve already gathered those documents in the previous step.

Notifying your insurer is a straightforward process that sets the stage for the next step: submitting your claim form.

Submitting the Claim Form

You’ll typically receive a claim form from your insurer after you’ve notified them about the investment scam.

Review the form carefully, as it’ll ask for details about the scam, your losses, and the policy that covers the investment.

Make sure you understand what information is required and what documentation you need to submit.

The claim form will likely ask for the following:

- Details about the scam: Provide as much information as possible about the scam, including the name of the scammer, the type of investment, and how you were contacted.

- Proof of investment: Submit documentation that proves you invested in the scam, such as receipts, bank statements, or contracts.

- Police report or complaint: If you’ve reported the scam to the authorities, include a copy of the police report or complaint with your claim form.

Complete the form accurately and thoroughly, and attach all required documentation.

Double-check that you’ve included everything before submitting the form to your insurer.

Responding to Insurer Inquiries

After submitting your claim form, the insurer may contact you to request additional information or clarification on certain details. It’s essential to respond promptly and provide the required information to avoid delays in your claim process.

When responding to insurer inquiries, it’s crucial to be clear and concise. You’ll typically be asked to provide documentation or answer questions regarding your investment scam losses. Here’s a breakdown of what you might expect:

| Request Type | Example of Required Information |

|---|---|

| Documentation | Police report, investment statements, and proof of payment |

| Transaction details | Dates, amounts, and methods of investment transactions |

| Communication records | Emails, letters, or phone records with the scammers |

| Identity verification | Government-issued ID, proof of address, or social security number |

| Additional context | Explanation of how you got involved with the scammers |

When providing information, ensure you keep a record of your communication with the insurer, including dates, times, and details of conversations. This will help you track the progress of your claim and ensure you’re meeting the insurer’s requirements.

Frequently Asked Questions

Can I File a Claim for Unsold Shares in the Scam Company?

If you invested in a company that turned out to be a fraud alert , you’re probably wondering about unsold shares. You can likely file a claim for those shares, but check your policy to confirm what’s covered and what’s not.

How Long Does It Take for the Insurer’s Investigation to Complete?

You’ll likely wait several weeks to months for the insurer’s investigation to wrap up, as they gather evidence and interview witnesses. It’s not uncommon for complex cases to take 6-12 months or even longer to complete.

Are Legal Fees Covered Under the Insurance Policy?

You’ll likely want to know if your policy covers legal fees. Check your policy documents or contact your insurer to see if they cover lawyer costs. Some policies may have specific limits or exclusions for legal fees.

Can I Claim for Emotional Distress or Mental Health Losses?

You’re likely wondering if you can claim for emotional distress or mental health losses. Typically, insurance policies cover financial losses, but some may also reimburse for counseling or therapy related to the traumatic event.

Will My Insurance Premiums Increase After Filing a Claim?

You’ll likely face increased premiums after filing a claim, as insurers view claimants as higher risks. Your rates might not skyrocket, but they’ll probably rise, so be prepared for higher future payments, unfortunately.

Conclusion

You’ve taken the first steps towards seeking compensation for your investment scam losses. By following these steps and providing clear documentation, you’ll increase your chances of a successful claim. Remember to stay responsive and cooperative throughout the process. Your prompt action and thorough preparation will help you navigate the claim process efficiently, bringing you closer to recovering from your financial loss and moving forward.