Crypto Staking Networks and Tax Implications What to Know

As you invest in crypto staking networks, you’ll want to understand the tax implications that come with it. Staking rewards are considered ordinary income, subject to income tax, and are classified as self-employment income. But that’s just the beginning – accurately reporting staking income and claiming losses can get complex. You’ll need to navigate Schedule 1 of Form 1040 and consider capital losses, all while minimizing your tax liability. But what specific tax-efficient strategies can you use to optimize your staking investments, and how can you avoid common pitfalls? The key to maximizing your returns lies in understanding these nuances. stakestone io.

Understanding Staking Rewards

Curiosity about crypto staking networks often begins with the promise of passive income, and staking rewards are at the heart of this appeal. You’re likely drawn to staking because it allows you to earn rewards without actively trading or buying/selling cryptocurrencies.

When you stake your digital assets, you essentially lock them up for a certain period, supporting the validation process of a blockchain network. In return, you receive a portion of the network’s transaction fees and sometimes a portion of the newly minted coins.

You’ll typically need to own a minimum amount of coins, often referred to as the “stake,” to participate in staking. The amount of rewards you earn depends on the network’s staking protocol, the number of coins you’ve staked, and the duration of the staking period.

Some networks offer fixed rewards, while others use a variable rate based on the network’s performance. It’s essential to understand the staking protocol and potential rewards before participating, as this can significantly impact your earnings.

Tax Classification of Staking

How do you classify your staking rewards for tax purposes? The classification of staking rewards can significantly impact your tax liability.

In the United States, the Internal Revenue Service (IRS) considers staking rewards as ordinary income, subject to income tax. This means you’ll need to report your staking rewards as taxable income on your tax return.

Your staking rewards are generally classified as self-employment income, as you’re providing a service to the network by validating transactions.

As a result, you’ll be considered self-employed and may be required to pay self-employment taxes on your staking rewards. Additionally, you may be able to deduct business expenses related to your staking activities, such as equipment costs or electricity expenses.

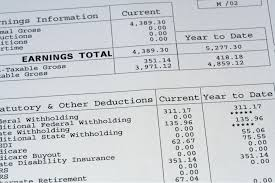

It’s essential to keep accurate records of your staking rewards, including the date and amount received, as well as any related expenses.

This will help you accurately report your staking income and claim any available deductions.

Reporting Staking Income

When reporting staking income, it’s crucial to get it right to avoid any potential tax implications or penalties. You’ll need to calculate the fair market value of the staking rewards received in a given tax year.

This typically involves tracking the date and time each reward is received, as well as the corresponding market value at that time. You’ll also need to keep accurate records of the rewards, including the block number, transaction ID, and wallet address.

If you’re staking through a third-party staking pool or service, you may receive a Form 1099-MISC or a similar statement that reports the income earned. However, it’s still your responsibility to accurately report this income on your tax return.

You’ll typically report staking income on Schedule 1 of Form 1040, which is used to report supplemental income. Be sure to consult with a tax professional or accountant to ensure you’re meeting all the necessary reporting requirements and taking advantage of available deductions. Keeping accurate records and seeking professional advice will help you navigate the complex world of crypto staking tax reporting.

Staking Losses and Deductions

If you’re staking cryptocurrencies, you’re not just concerned with reporting income – you’ll also want to account for potential losses and deductions.

Calculating staking losses can be challenging, as it requires tracking the initial cost basis of your staked assets, as well as any subsequent transactions.

If you sell or dispose of staked assets at a loss, you can claim a capital loss on your tax return. This loss can be used to offset gains from other investments, potentially reducing your tax liability.

When it comes to deductions, you may be eligible to claim expenses related to staking, such as hardware, electricity, and internet costs.

These expenses can be deducted as business expenses on your tax return, provided you’re staking with the intention of generating income.

You’ll need to keep accurate records of these expenses, including receipts and invoices, to support your deductions.

It’s essential to consult with a tax professional to ensure you’re taking advantage of all eligible deductions and losses.

Crypto Staking Tax Strategies

Tax planning is crucial for crypto staking investors, as it can significantly impact your bottom line. You can use various tax strategies to minimize your tax liability and maximize your staking rewards.

One approach is to hold your staking rewards for at least a year to qualify for long-term capital gains tax rates, which are generally lower than short-term rates.

Another strategy is to offset your staking gains with losses from other investments, such as stocks or other cryptocurrencies.

If you have a staking loss, you can use it to reduce your taxable income or offset gains from other investments. You can also consider staking in a tax-advantaged account, such as a retirement account, to defer taxes on your staking rewards.

Additionally, you may want to consider the tax implications of staking in different jurisdictions.

Some countries have more favorable tax laws for crypto staking, while others may have stricter regulations. By understanding the tax laws in your jurisdiction and using tax-efficient strategies, you can minimize your tax liability and maximize your staking rewards.

Conclusion

You’ve navigated the complexities of crypto staking networks and their tax implications. To recap, staking rewards are considered ordinary income and subject to self-employment tax. You must accurately report this income and claim losses as capital losses. By utilizing tax-efficient strategies, such as holding staking rewards for a year or offsetting gains with other losses, you can minimize your tax liability. Stay informed to optimize your crypto staking investments.