The Process of Filing for Bankruptcy: A Lawyers Guide

As a lawyer, you're likely familiar with the complexities of filing for bankruptcy, but even seasoned attorneys can benefit from a refresher on the intricacies of the process. You'll start by assessing client eligibility, evaluating their income, debts, and financial situation to determine if bankruptcy is the best course of action. But that's just the beginning – choosing the right bankruptcy chapter can significantly impact the outcome of the case. What are the key considerations when selecting between Chapter 7, Chapter 11, or Chapter 13, and how will it affect your client's financial future? bankruptcy lawyer texas.

Assessing Client Eligibility

When considering filing for bankruptcy, assessing client eligibility is the first crucial step. As a lawyer, you'll need to determine if your client qualifies for bankruptcy protection.

Start by evaluating your client's income, debts, and financial situation to determine if they meet the eligibility requirements.

You'll need to consider factors such as your client's residency, income level, and type of debts. Generally, individuals and businesses can file for bankruptcy, but there are specific requirements and restrictions.

For instance, your client must have filed all required tax returns and not have been convicted of certain crimes, such as bankruptcy fraud.

If your client has previously filed for bankruptcy, you'll need to determine if they're eligible to file again.

The time between filings, known as the "waiting period," varies depending on the type of bankruptcy and the outcome of the previous filing.

By carefully assessing your client's eligibility, you can ensure they're on the right path and set the stage for a successful bankruptcy filing.

This initial assessment will also help you identify potential issues and develop a strategy for moving forward.

Choosing the Right Chapter

Selecting the right chapter of bankruptcy is a critical decision that will significantly impact the outcome of your client's case. You must carefully evaluate their financial situation, goals, and eligibility requirements to determine which chapter is most suitable.

The most common chapters for individuals are Chapter 7 and Chapter 13.

Chapter 7, also known as liquidation, involves the sale of non-exempt assets to pay off creditors, and it's often the best option for those with limited income and few assets.

On the other hand, Chapter 13 is a reorganization plan that allows clients to repay a portion of their debts over time, usually 3-5 years.

This chapter is ideal for those who've a steady income, significant assets, or want to save their home from foreclosure.

When choosing the right chapter, you should also consider other factors such as the client's business needs, if any.

For instance, Chapter 11 is typically used for businesses looking to restructure their debts, while Chapter 12 is designed for family farmers and fishermen.

Filing the Bankruptcy Petition

Now that you've determined the most suitable bankruptcy chapter for your client, it's time to focus on the paperwork required to initiate the process. The first step is to prepare and file the bankruptcy petition, which is a comprehensive document that provides detailed information about your client's financial situation.

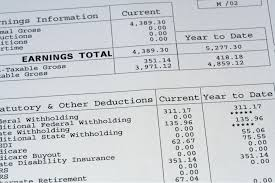

This includes their income, expenses, assets, debts, and creditors. You'll need to gather all the necessary financial documents, such as tax returns, pay stubs, and bank statements, to complete the petition.

It's essential to ensure that the information is accurate and complete, as any errors or omissions can lead to delays or even dismissal of the case. The petition must be signed by your client, and you'll need to verify that they've read and understood the contents.

Once the petition is complete, you'll need to file it with the bankruptcy court, along with the required filing fee. You can file electronically or by mail, depending on the court's requirements.

After filing the petition, the court will assign a case number and schedule a meeting of creditors, marking the beginning of the bankruptcy process.

Navigating the Bankruptcy Process

Filing the bankruptcy petition marks the beginning of a complex and time-sensitive process.

As you navigate this process, you'll need to gather and submit additional financial information, including pay stubs, bank statements, and tax returns.

This information will help the court and creditors understand your financial situation.

You'll also need to complete a credit counseling course, which is a requirement for bankruptcy filers.

This course will help you understand your financial options and create a plan for managing debt.

In addition, you'll need to respond to any objections or concerns raised by creditors or the court.

This may involve negotiating with creditors or providing additional information to support your bankruptcy claim.

Throughout the process, you'll need to stay organized and keep track of deadlines and requirements.

It's essential to work closely with your attorney to ensure you're meeting all the necessary requirements and avoiding common pitfalls.

Discharging and Rebuilding Debt

Discharging and Rebuilding Debt

After navigating the bankruptcy process, you're likely eager to start rebuilding your financial life. Discharging your debt is a crucial step in this process. When your debt is discharged, you're no longer liable for it, and creditors can't collect from you.

This typically happens at the end of your bankruptcy case, but it can also occur during the process.

You'll receive a discharge order once your case is complete. This document serves as proof that your debt has been discharged.

Keep it in a safe place, as you may need it to show creditors that you're no longer responsible for the debt. Creditors will also receive notice of the discharge, so they'll know not to contact you.

Now that your debt is discharged, you can start rebuilding your credit.

Start by making on-time payments on any remaining debts, such as student loans or mortgages.

You can also consider opening a new credit account to start establishing a positive credit history.

With time and responsible financial decisions, you can rebuild your credit and achieve financial stability.

Conclusion

You've navigated the complex process of filing for bankruptcy, from assessing client eligibility to discharging and rebuilding debt. By choosing the right chapter and carefully preparing the bankruptcy petition, you've set your client on the path to financial recovery. Now, it's essential to stay vigilant and guide them through the remainder of the process, addressing any challenges that arise and ensuring a successful outcome.